INVESTMENT PROCESS

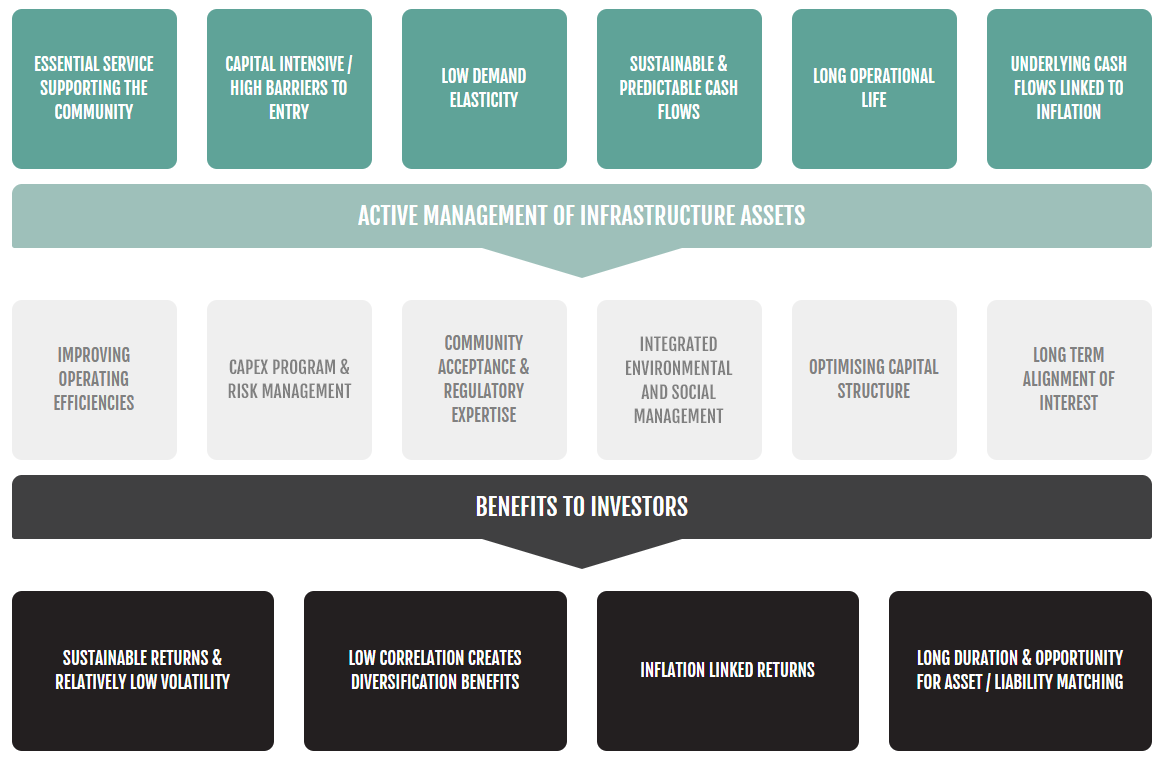

The Funds managed and advised by us focus on equity investments into core and value added infrastructure projects in Africa that provide essential services to communities, have a strategic competitive advantage, require significant capital expenditure and are expected to generate strong risk-adjusted returns for investors.